How to Find Affordable Home Care Services

Explore strategies and resources for finding affordable in-home care options that fit your budget and needs.

How to Find Affordable Home Care Services

Understanding Home Care Costs and Your Budget

Finding affordable home care services is a top priority for many families. The cost of in-home care can vary significantly based on the type of services needed, the number of hours, and your geographic location. Before diving into specific strategies, it's crucial to have a clear understanding of your budget and the typical costs in your area. In the United States, non-medical home care, such as personal care and companionship, can range from $20 to $35 per hour. Skilled nursing care at home will be considerably higher. In Southeast Asian markets like Thailand or the Philippines, costs can be lower, but quality and regulatory standards might differ. Knowing these averages helps set realistic expectations.

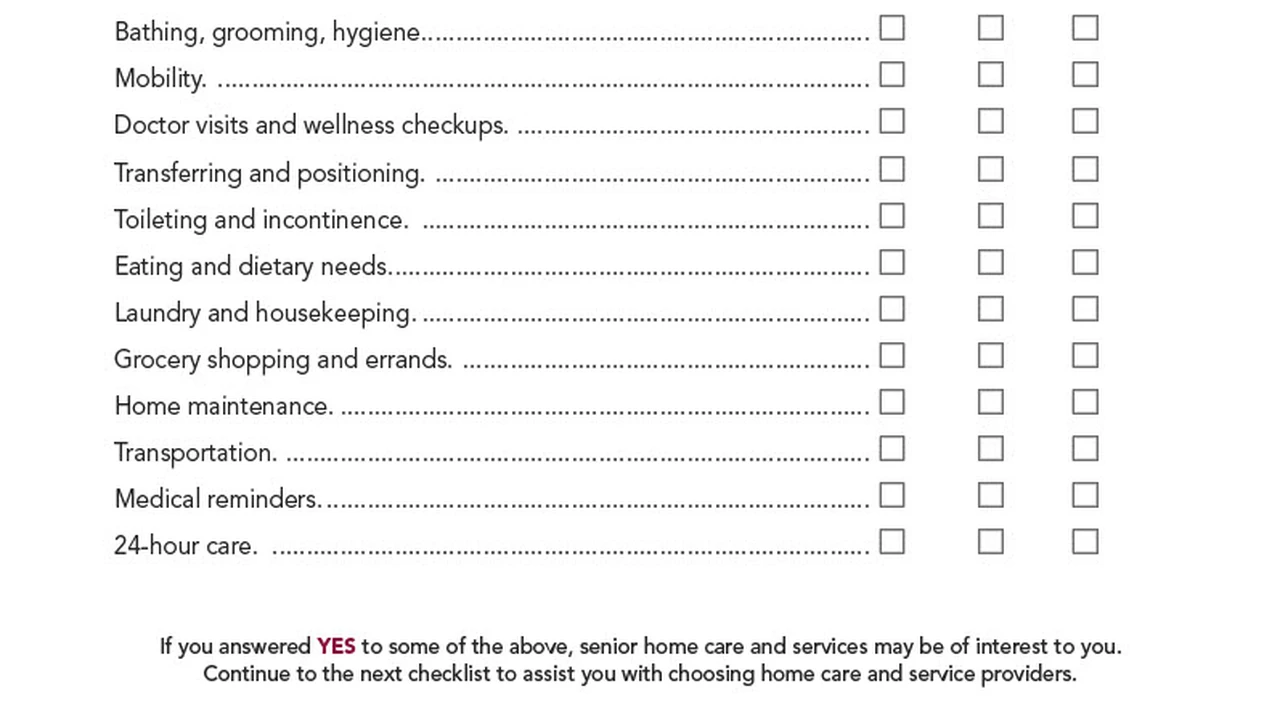

Consider what services are absolutely essential versus those that would be nice to have. Do you need assistance with activities of daily living (ADLs) like bathing, dressing, and eating? Or is it primarily companionship, meal preparation, and light housekeeping? Prioritizing needs will help you tailor a care plan that is both effective and financially manageable. Many families start with a few hours a week and gradually increase care as needs evolve.

Leveraging Government Programs and Benefits for Home Care

One of the first avenues to explore for affordable home care is government assistance programs. These programs vary significantly by country and even by state or region within a country.

Medicaid and State-Specific Home Care Programs

In the United States, Medicaid is a primary source of funding for long-term care, including home care services, for low-income individuals. Each state has its own Medicaid program, often with waivers that allow for home and community-based services (HCBS) as an alternative to nursing home care. These waivers can cover a wide range of services, from personal care to skilled nursing and even home modifications. Eligibility requirements are strict, typically based on income and asset limits, as well as a functional need for care.

For example, in Florida, the Statewide Medicaid Managed Care Long-Term Care (SMMC-LTC) program provides services to eligible seniors and adults with disabilities, including in-home personal care, homemaker services, and respite care. In California, the Medi-Cal program offers similar services through various waivers and managed care plans. It's essential to contact your state's Medicaid office or Area Agency on Aging to understand specific eligibility criteria and application processes.

Veterans Benefits for In-Home Care Assistance

If your loved one is a veteran or the surviving spouse of a veteran, they might be eligible for benefits through the U.S. Department of Veterans Affairs (VA). The Aid and Attendance benefit is particularly relevant for those needing assistance with ADLs. This pension can provide significant financial support to help cover the costs of in-home care, assisted living, or nursing home care. Eligibility depends on service history, income, assets, and the need for daily assistance. The application process can be complex, so working with an accredited VA representative or elder law attorney is highly recommended.

Other Federal and State Assistance Programs for Seniors

Beyond Medicaid and VA benefits, there are other federal and state programs that might offer financial assistance or resources for home care. The Older Americans Act, for instance, funds various services through Area Agencies on Aging (AAAs), which can include information and referral, case management, and sometimes direct financial assistance for specific services. Some states also have non-Medicaid programs designed to help seniors age in place, often with less stringent financial requirements than Medicaid. Researching these local resources is a crucial step.

Exploring Private Funding and Insurance Options for Home Care

For those who don't qualify for government assistance or prefer more flexibility, private funding and insurance options become vital.

Long-Term Care Insurance Policies and Benefits

If your loved one purchased a long-term care insurance policy years ago, now is the time to review it. These policies are specifically designed to cover the costs of long-term care, including in-home care, assisted living, and nursing home care. The benefits vary widely depending on the policy, including daily benefit amounts, elimination periods (deductibles), and benefit periods. Contacting the insurance provider to understand the claims process and what services are covered is essential. Many policies offer significant coverage for in-home care, which can substantially reduce out-of-pocket expenses.

Converting Life Insurance Policies for Home Care Funds

Did you know that a life insurance policy can be a valuable asset for funding home care? There are several ways to convert a life insurance policy into funds for care:

- Life Settlement: Selling your life insurance policy to a third party for a lump sum cash payment that is more than the cash surrender value but less than the death benefit. This option is typically for policies with a death benefit of $100,000 or more.

- Viatical Settlement: Similar to a life settlement, but specifically for individuals with a life expectancy of two years or less due to a terminal illness. The payout is usually a higher percentage of the death benefit.

- Accelerated Death Benefits (ADB): Many life insurance policies include an ADB rider, which allows policyholders to access a portion of their death benefit while still alive if they have a terminal or chronic illness. This can be a great way to fund home care without selling the policy outright.

- Life Insurance Conversion Programs: Some companies specialize in converting life insurance policies into long-term care benefits, often through a trust or annuity structure.

These options can provide a significant influx of cash to pay for home care, but it's crucial to understand the tax implications and consult with a financial advisor or elder law attorney.

Reverse Mortgages and Home Equity for Senior Care

For homeowners, a reverse mortgage can be a way to convert a portion of their home equity into tax-free cash without having to sell the home or make monthly mortgage payments. The loan is repaid when the last borrower moves out, sells the home, or passes away. The funds from a reverse mortgage can be used for any purpose, including paying for in-home care services. It's a complex financial product, so thorough research and consultation with a HUD-approved counselor are vital to ensure it's the right choice for your situation.

Family Contributions and Care Agreements

Often, family members are the primary caregivers or contribute financially to a loved one's care. Formalizing these arrangements with a written care agreement can be beneficial. A care agreement outlines the services provided by a family caregiver, the compensation they receive, and other terms. This not only ensures clarity and fairness but can also be important for Medicaid planning, as payments to family caregivers under a formal agreement may not be considered gifts. Additionally, pooling resources among siblings or other family members can make home care more affordable for everyone involved.

Smart Strategies for Reducing Home Care Costs and Maximizing Value

Beyond funding sources, there are practical strategies you can employ to reduce the overall cost of home care while ensuring quality.

Hiring Independent Caregivers vs Home Care Agencies

One of the biggest cost differences comes from how you hire caregivers. Hiring an independent caregiver directly can often be significantly cheaper than going through a home care agency. Agencies handle recruitment, screening, training, scheduling, payroll, taxes, and insurance, which adds to their overhead and, consequently, their rates. However, when you hire independently, you become the employer, responsible for all these tasks, including background checks, managing schedules, and handling payroll taxes. This requires more time and effort but can save money.

Comparison:

- Independent Caregiver:

- Pros: Lower hourly rates (often $15-$25/hour), more direct control over care, potential for a more personal relationship.

- Cons: You are the employer (payroll, taxes, insurance, background checks), no backup caregiver if sick, less oversight, potential for legal issues if not handled correctly.

- Home Care Agency:

- Pros: Agency handles all employment responsibilities, screened and trained caregivers, backup caregivers, supervision and quality assurance, liability insurance.

- Cons: Higher hourly rates (often $25-$35+/hour), less direct control over caregiver selection.

For families considering independent caregivers, services like Care.com or AgingCare.com can help you find local caregivers. However, remember to conduct thorough interviews, reference checks, and background checks yourself. For payroll and tax assistance, services like Care.com HomePay or NannyPay can simplify the employer responsibilities.

Optimizing Care Schedules and Service Needs

Carefully assess the actual hours of care needed. Do you need 24/7 care, or can you manage with a few hours a day, or even just a few days a week? Many families start with a minimal schedule and adjust as needs change. Consider splitting shifts among family members or utilizing adult day care programs for a portion of the day to reduce the number of paid home care hours. For example, if your loved one primarily needs assistance in the mornings and evenings, you might hire a caregiver for those specific blocks of time rather than a full eight-hour shift.

Also, be clear about the specific services required. If you only need companionship and meal prep, you might not need a caregiver with advanced medical training, which can be more expensive. Tailoring the care plan precisely to needs can prevent overspending on unnecessary services.

Utilizing Technology for Remote Monitoring and Support

Technology can play a significant role in reducing the need for constant in-person care, thereby lowering costs. Smart home devices, medical alert systems, and remote monitoring tools can provide peace of mind and extend independence.

- Medical Alert Systems: Devices like Life Alert or Philips Lifeline (starting around $30/month) provide immediate access to emergency services with the push of a button. Some advanced systems include fall detection.

- Smart Home Devices: Smart speakers (e.g., Amazon Echo Show, Google Nest Hub – starting around $50-$100) can be used for medication reminders, making calls to family, and even video check-ins. Smart lights and thermostats can improve comfort and safety.

- Remote Monitoring Systems: Companies like GrandCare Systems or CarePredict offer comprehensive platforms that monitor activity, sleep patterns, medication adherence, and even vital signs, alerting family members to potential issues. These systems can range from $100-$500 for equipment plus monthly service fees ($50-$150).

- Medication Dispensers: Automated medication dispensers (e.g., PillPack by Amazon Pharmacy, MedMinder – starting around $50/month for service) ensure medications are taken on time, reducing the need for a caregiver to be present solely for medication management.

These technologies don't replace human care entirely but can significantly supplement it, allowing for fewer paid care hours and greater independence for the senior.

Community Resources and Non-Profit Organizations for Home Care Support

Don't overlook the wealth of support available through local community organizations and non-profits.

Area Agencies on Aging (AAAs) and Senior Centers

As mentioned, AAAs are a fantastic resource. They can provide information on local home care providers, financial assistance programs, and other senior services. Many AAAs also offer direct services like transportation, meal delivery (e.g., Meals on Wheels), and caregiver support groups. Senior centers often provide low-cost or free activities, meals, and health screenings, which can reduce the need for certain in-home services and provide social engagement.

Disease-Specific Organizations and Support Groups

If your loved one has a specific condition like Alzheimer's, Parkinson's, or cancer, disease-specific organizations can be invaluable. The Alzheimer's Association, for example, offers extensive resources, support groups, and sometimes even grants for respite care or financial assistance for families dealing with dementia. These organizations often have lists of vetted home care providers experienced with specific conditions.

Volunteer Programs and Faith-Based Organizations

Many communities have volunteer programs that offer free or low-cost assistance to seniors, such as friendly visits, transportation to appointments, or help with errands. Faith-based organizations (churches, synagogues, mosques, temples) often have outreach programs that provide similar support to their members or the wider community. These services can help fill gaps in care and provide much-needed companionship without the hourly cost of a professional caregiver.

Navigating Home Care in Southeast Asia: Unique Considerations

For families in or considering home care in Southeast Asia, the landscape has unique characteristics.

Cultural Nuances and Family Involvement in Home Care

In many Southeast Asian cultures, family plays a central role in elder care. It's common for multiple generations to live together, and family members often provide the bulk of care. However, as societies modernize and families become more dispersed, the demand for professional home care is growing. When seeking home care, understanding and respecting local cultural norms regarding elder care, communication, and personal space is crucial. Caregivers from these regions often bring a strong sense of respect and familial warmth to their roles.

Emerging Home Care Markets and Quality Standards

Countries like Thailand, the Philippines, and Malaysia are seeing a rise in professional home care services, often catering to both local populations and expatriates. While costs can be significantly lower than in Western countries (e.g., $5-$15/hour for basic care), it's vital to thoroughly vet providers. Look for agencies with clear licensing, training standards, and good references. Quality can vary, so due diligence is paramount. Some agencies may specialize in care for Western clients, offering English-speaking caregivers and understanding of Western cultural expectations.

Examples of Home Care Providers in Southeast Asia:

- Home Care Asia (Thailand): Offers a range of services from personal care to skilled nursing, often catering to expatriates. Prices vary based on service and hours, but generally more affordable than Western counterparts.

- CareLink (Philippines): Provides professional home care services, including nursing care, therapy, and personal assistance. They emphasize trained and certified caregivers.

- Homage (Singapore, Malaysia): A technology-driven platform connecting families with trained caregivers for various needs, including personal care, nursing, and companionship. They offer transparent pricing and caregiver matching.

When exploring these options, always request detailed service agreements, caregiver qualifications, and emergency protocols. The regulatory environment for home care in Southeast Asia is still developing in some areas, so personal vetting is key.

Final Thoughts on Finding Affordable Home Care

Finding affordable home care services requires a multi-faceted approach. Start by thoroughly assessing your needs and budget. Explore all available government programs, veterans benefits, and insurance options. Consider private funding strategies like life insurance conversions or reverse mortgages. Be strategic in how you hire and schedule care, and don't underestimate the power of technology and community resources. Whether you're in the US or Southeast Asia, a well-researched and thoughtful plan can help you secure quality, affordable home care that allows your loved one to age comfortably and safely in their own home.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)