5 Questions to Ask a Financial Advisor for Senior Care

Prepare for your financial planning meetings with these essential questions to ensure comprehensive senior care funding strategies.

Prepare for your financial planning meetings with these essential questions to ensure comprehensive senior care funding strategies. Navigating the financial landscape of senior care can feel like a maze. Whether you're planning for yourself or a loved one, the costs associated with independent living, assisted living, memory care, or in-home services can be substantial and complex. That's where a qualified financial advisor specializing in elder care planning comes in. They can help you understand your options, optimize your assets, and create a sustainable plan. But to get the most out of your consultation, you need to ask the right questions. This guide will walk you through five crucial questions, along with detailed explanations, product recommendations, and comparative insights to empower your decision-making process.

5 Questions to Ask a Financial Advisor for Senior Care

Understanding Your Current Financial Picture and Senior Care Goals

Before diving into specific products or strategies, it's vital to ensure your financial advisor fully grasps your current situation and future aspirations. This foundational discussion sets the stage for all subsequent planning.

Question 1: How do my current assets and income streams align with potential senior care costs, and what are the projected gaps?

This question is about getting a realistic assessment of your financial standing against the backdrop of senior care expenses. Senior care costs vary wildly depending on the type of care, geographic location, and level of services required. For instance, in Florida, the median cost for assisted living is around $4,000 per month, while a private room in a nursing home can exceed $9,000 per month. In Southeast Asian markets like Thailand or Malaysia, these costs might be lower but are still significant relative to local incomes, often ranging from $1,000 to $3,000 USD per month for assisted living-like services, with higher-end options approaching US prices.

Your advisor should help you:

- Itemize all assets: This includes savings accounts, investments (stocks, bonds, mutual funds), real estate (primary residence, vacation homes), retirement accounts (401k, IRA), and any other valuable possessions.

- Detail all income streams: Social Security, pensions, rental income, dividends, and any ongoing employment.

- Estimate potential care costs: Based on your health status, preferences, and local market rates, they should provide a range of potential monthly and annual costs for different care scenarios (e.g., 5 years of assisted living, 10 years of in-home care).

- Identify potential shortfalls: This is the critical part. If your current assets and income won't cover projected costs, you need to know by how much and for how long.

Product/Strategy Spotlight: Long-Term Care Cost Calculators & Financial Projections

While not a product to buy, your advisor should utilize sophisticated financial planning software that includes long-term care cost calculators. These tools can project future costs, factoring in inflation (which for healthcare often outpaces general inflation). For example, tools like those offered by Fidelity or Vanguard often have robust planning modules. They can run various scenarios, such as: 'What if I need 5 years of assisted living?' or 'What if I need 10 years of skilled nursing care?'

Comparison: DIY vs. Advisor Projections

You can find free online calculators, but an advisor's tools are usually more comprehensive, allowing for personalized inputs, tax considerations, and integration with your overall financial plan. They can also account for regional cost differences more accurately.

Exploring Funding Mechanisms and Senior Care Insurance Options

Once you understand the potential gaps, the next step is to explore how to fill them. This often involves a combination of insurance, government benefits, and strategic asset utilization.

Question 2: What are the most suitable long-term care insurance or hybrid policy options for my situation, and what are their pros and cons?

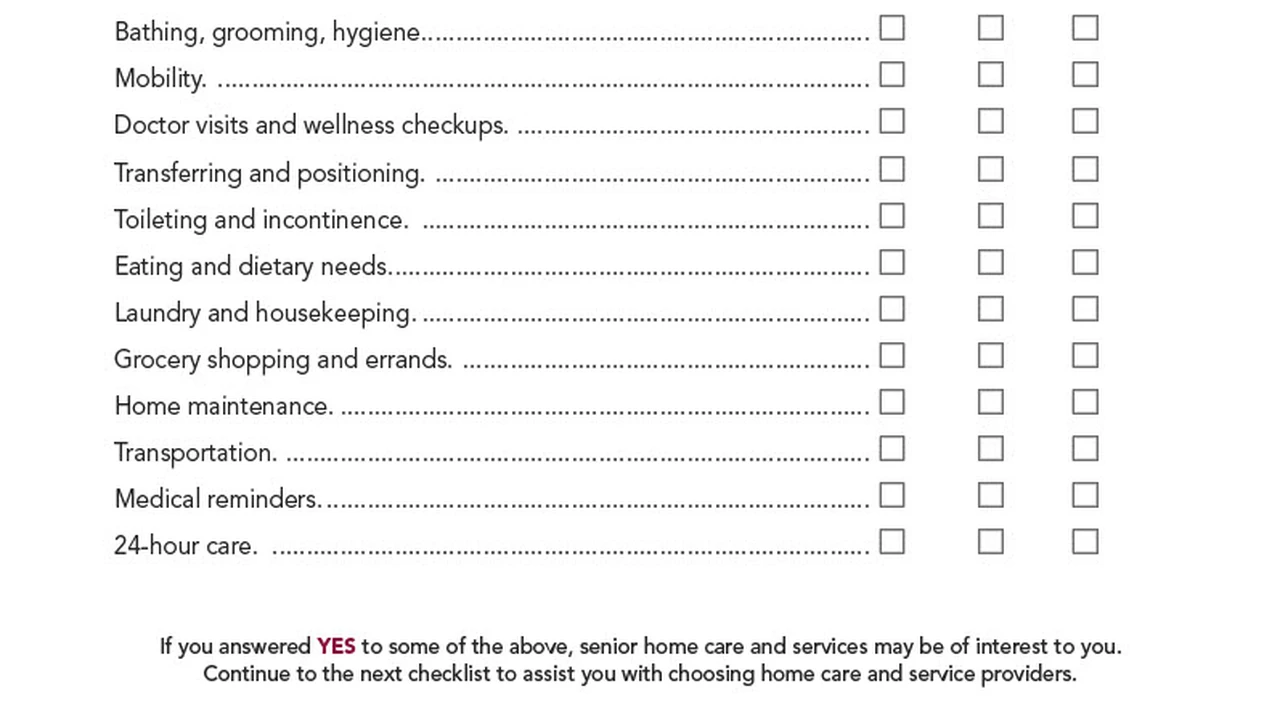

Long-term care (LTC) insurance is designed to cover the costs of services not typically covered by health insurance, such as assistance with daily activities (bathing, dressing, eating) in a nursing home, assisted living facility, or at home. Hybrid policies combine LTC benefits with life insurance or an annuity.

Your advisor should explain:

- Traditional LTC Insurance:

- Pros: Can provide substantial coverage for long-term care needs, often with inflation protection. Premiums can be tax-deductible in some cases.

- Cons: Premiums can be expensive, especially if purchased later in life. Premiums can increase over time. If you never use it, you don't get your money back.

- Example Product: Policies from companies like Genworth, Mutual of Omaha, or Transamerica. A typical policy for a 55-year-old might cost $2,000-$3,000 annually for a daily benefit of $150-$200 and a 3-year benefit period.

- Hybrid Life/LTC Policies:

- Pros: Offers a death benefit if LTC isn't needed, or provides LTC benefits if it is. Premiums are often guaranteed not to increase. Can be funded with a single lump sum or over a set period.

- Cons: The LTC benefit might be less robust than a traditional LTC policy for the same premium. The death benefit is reduced if LTC benefits are used.

- Example Product: Pacific Life's PremierCare, Lincoln Financial's MoneyGuard, or OneAmerica's Asset Care. A single premium of $100,000 for a 60-year-old might provide $300,000 in LTC benefits or a $150,000 death benefit.

- Hybrid Annuity/LTC Policies:

- Pros: Uses an annuity as the base, offering tax-deferred growth. If LTC is needed, the annuity value is leveraged to provide enhanced LTC benefits. If not, it functions as a regular annuity.

- Cons: Less common than life/LTC hybrids. The growth potential of the annuity might be lower than other investment options.

- Example Product: Nationwide CareMatters II. A $100,000 premium for a 65-year-old might offer a 3x multiplier for LTC, providing $300,000 in benefits.

Comparison: Traditional vs. Hybrid LTC

Traditional LTC is often best for those primarily concerned with maximizing LTC coverage and comfortable with potential premium increases. Hybrid policies appeal to those who want a 'use it or lose it' alternative, ensuring some benefit (death benefit or annuity value) even if LTC isn't needed. The cost of hybrid policies can sometimes be higher upfront, but the guaranteed premiums offer peace of mind.

Optimizing Assets and Senior Care Estate Planning Strategies

Beyond insurance, how you structure your existing assets can significantly impact your ability to pay for care and protect your legacy.

Question 3: What strategies can we employ to protect assets while planning for potential Medicaid eligibility or other government benefits?

Medicaid is a state and federal program that can cover long-term care costs for individuals with limited income and assets. However, there are strict eligibility rules, and 'spending down' assets incorrectly can lead to penalties. Your advisor, often in conjunction with an elder law attorney, should discuss:

- Medicaid Planning:

- Look-Back Period: Explain the 5-year look-back period for asset transfers and how it impacts eligibility.

- Exempt Assets: Identify assets that are typically exempt from Medicaid calculations (e.g., primary residence up to a certain equity limit, one car, personal belongings).

- Asset Protection Trusts (Irrevocable Trusts):

- Pros: Assets placed in an irrevocable trust are generally protected from Medicaid spend-down after the look-back period. They can also avoid probate.

- Cons: You lose control over the assets once they are in the trust. It's a complex legal tool requiring careful consideration and legal counsel.

- Example: A 'Medicaid Asset Protection Trust' (MAPT) or 'Irrevocable Income Only Trust.' These are not off-the-shelf products but custom legal documents. The cost for setting one up can range from $3,000 to $7,000, depending on complexity and location.

- Gifting Strategies: Discuss permissible gifting amounts and how large gifts can trigger the look-back penalty.

- Veterans Benefits (Aid & Attendance):

- Pros: A non-service-connected pension benefit for wartime veterans and their surviving spouses who require assistance with daily living. Can provide significant monthly income to help pay for care.

- Cons: Strict income and asset limits apply. The application process can be lengthy and complex.

- Example: A single veteran could receive over $2,000 per month, a surviving spouse over $1,300, and a married veteran over $2,500 (as of 2024).

Comparison: Medicaid Planning vs. Veterans Benefits

Medicaid planning is for those with limited resources who anticipate needing long-term care and want to preserve some assets for their spouse or heirs. Veterans Aid & Attendance is a specific benefit for eligible veterans and spouses, often used to supplement other income for care costs. An advisor can help determine eligibility for both and integrate them into a comprehensive plan.

Evaluating Housing and Senior Living Options with Financial Implications

The choice of senior living environment has significant financial ramifications. Your advisor should help you understand these costs and how they fit into your overall plan.

Question 4: How can we best utilize my home equity to fund senior care, and what are the financial implications of different senior living arrangements?

For many seniors, their home is their largest asset. Tapping into that equity can be a crucial part of funding care.

- Utilizing Home Equity:

- Selling the Home:

- Pros: Provides a lump sum of cash, eliminates property taxes, insurance, and maintenance costs.

- Cons: Emotional attachment, potential capital gains tax (though often exempt for primary residences up to a certain amount), market timing risks.

- Reverse Mortgage:

- Pros: Allows you to convert a portion of your home equity into tax-free cash without selling your home or making monthly mortgage payments (you still pay property taxes and insurance). You retain ownership.

- Cons: Interest accrues, reducing home equity over time. Can be complex and have higher fees than traditional mortgages. The loan becomes due when the last borrower leaves the home permanently.

- Example Product: Home Equity Conversion Mortgage (HECM) is the most common type of reverse mortgage, insured by the FHA. Lenders include AAG, Reverse Mortgage Funding, and Liberty Reverse Mortgage. The amount you can borrow depends on your age, interest rates, and home value. For a $500,000 home, a 70-year-old might access $200,000-$250,000.

- Home Equity Line of Credit (HELOC) or Home Equity Loan:

- Pros: Access to funds while retaining ownership. HELOCs offer flexibility to borrow as needed.

- Cons: Requires monthly payments (principal and interest). If you can't make payments, you risk foreclosure.

- Example Product: Available from most banks and credit unions (e.g., Chase, Bank of America, Wells Fargo). Interest rates vary but are typically tied to the prime rate for HELOCs.

- Financial Implications of Senior Living Arrangements:

- Independent Living: Typically monthly rent, plus utilities and optional services. Less expensive than assisted living.

- Assisted Living: Monthly fees cover rent, meals, personal care, and some activities. Costs vary significantly based on care level.

- Memory Care: Often the most expensive, due to specialized staff, secure environments, and tailored programs.

- Continuing Care Retirement Communities (CCRCs): Offer a continuum of care from independent living to skilled nursing. Involve an entrance fee (which can be substantial, from $100,000 to over $1 million) plus monthly fees. The financial structure can be complex (Type A, B, C contracts).

Comparison: Reverse Mortgage vs. Selling Home

A reverse mortgage allows you to stay in your home and access equity, but it reduces your heirs' inheritance. Selling provides immediate cash and simplifies finances but requires moving. The best choice depends on your desire to stay in your home, your overall financial needs, and your legacy goals.

Ongoing Review and Senior Care Plan Adjustments

Financial planning for senior care isn't a one-time event; it's an ongoing process that needs regular review and adjustment.

Question 5: How often should we review this senior care financial plan, and what factors would necessitate an immediate re-evaluation?

Life changes, market conditions shift, and healthcare needs evolve. Your financial advisor should emphasize the dynamic nature of your plan.

- Regular Review Schedule:

- Typically, an annual review is recommended to assess progress, update projections, and make minor adjustments.

- For those closer to needing care or with rapidly changing health, semi-annual reviews might be more appropriate.

- Factors Requiring Immediate Re-evaluation:

- Significant Health Changes: A new diagnosis, a sudden decline in health, or an unexpected injury that increases care needs.

- Changes in Family Situation: Death of a spouse, a child moving closer or further away, or a change in a family member's ability to provide care.

- Major Financial Events: A large inheritance, a significant market downturn, unexpected expenses, or changes in income (e.g., retirement).

- Changes in Government Benefits or Laws: Updates to Medicare, Medicaid, or VA benefits, or new tax laws that impact senior care funding.

- Changes in Care Costs: If local senior care costs increase significantly beyond projections.

Product/Strategy Spotlight: Financial Planning Software & Client Portals

Many financial advisors use client portals (e.g., eMoney Advisor, RightCapital) that allow you to view your financial plan, track progress, and communicate securely. These tools can help you stay engaged with your plan between formal review meetings.

Comparison: Active vs. Passive Plan Management

A passive approach means setting a plan and rarely looking at it, which can lead to unpleasant surprises. An active approach, with regular reviews and open communication with your advisor, ensures your plan remains relevant and effective, adapting to life's inevitable changes.

By asking these five essential questions, you'll not only gain a clearer understanding of your senior care financial options but also build a stronger, more collaborative relationship with your financial advisor. This proactive approach is key to securing peace of mind and ensuring quality care for yourself or your loved ones in the years to come.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)